Crony capitalism is a stepping-stone to socialism. The term is used to describe the unholy, anti-citizen alliances between corporations and big government. These kinds of companies generally engage in massive lobbying efforts (read: backscratching) to coerce government into various taxpayer-funded schemes:

• by paying them directly through government purchases...

• by carving out market segments for them through regulation...

• and otherwise increasing profit margins by suppressing the free market.

With this as our context, let's examine The American Spectator's article entitled "What Do Nike, Best Buy, Levi Strauss and Target Have in Common?".

They all support EPA efforts to regulate greenhouse gases, even though that circumvents the citizens' right to have their elected representatives make U.S. laws. More on the Obama Administration overreach and his crony corporatists support at the National Legal and Policy Center blog today.

Heading over to the NLPC, we can discover the sordid details.

Earlier this month corporate climateers including Nike and 3M were given awards -- supposedly "the equivalent of an Oscar for the climate change mitigation world" -- for their efforts to reduce their carbon emissions... Nike also co-signed a letter to President Obama that called for U.S. leadership in an initiative to create and finance the Global Climate Fund, which was established at the UN climate talks in Cancun in early December.

Other members of [this group include] Levi Strauss & Co., Starbucks, Timberland, Best Buy, Ben & Jerry's, eBay, Gap Inc., The North Face, and Target Corporation. Mark them down as corporations who favor the circumvention of the peoples' right to have their elected representatives make U.S. laws.

Carbon dioxide is plant food. It can no more be a pollutant than water vapor or oxygen. The Marxist Left progressives believe, or want us to think they believe, that capping CO2 emissions can act as a thermostat on the climate.

The reality is quite different. Trying to control carbon dioxide is a money-making scam and it has been since the original IPCC reports that were issued by folks poised to make millions through inherent conflicts-of-interest.

Companies that feed this government-run monstrosity should be treated as the anti-free market pariahs they are.

Image: Fox News.

We don't have enough public market acquirers to sustain the start-up ecosystem.

That was the real back story that explains why Google failed to close a deal to buy

Groupon. Groupon wanted to

sell to Google for $6 billion. Of course they did, that is a huge amount of money – real cold hard cash – for a 2 year old

venture. Do you really think they turned that down for the vague possibility of

making more from an IPO in the distant future? Yes we all hear the stories of

visionary entrepreneurs who are such bold risk-takers and some of that is true but

most entrepreneurs don’t love risk, they love eliminating risk on the way to

building a venture. The real story is that Groupon only backed off due to worries that the deal

would fall into AntiTrust

hurdles.

If we only have a handful of acquiring companies (basically today it is Google,

Amazon and Microsoft, now that eBay and Yahoo are wounded), the AntiTrust hurdle becomes more real. Even

if there is no AntiTrust

issue, Google, Amazon and Microsoft simply cannot buy all those venture-backed

companies.

So we need Groupon to go public and use their public

currency to buy other ventures working on local advertising/ecommerce. That will be

good news for lots of ventures. And a Groupon IPO success

will spur on other ventures that are getting ready for IPO.

I don’t know if Groupon really have the solid

financials to go public. We won’t know until they issue their prospectus to the

SEC. Until then we only have rumor and speculation. But if I were a betting man, I

would bet on Groupon being able to go public before

Twitter. And, this will be more controversial, before Facebook. But that as they say is another story. I am not trying here

to compile an actual list of ventures that could IPO in 2011. This is more about the

general environment for IPOs.

This has been what Steve Blank calls the “lost

decade” for tech IPOs. So why do I think that 2011 will be the year this

changes? There are 5 reasons:

- Private

markets are under SEC scrutiny. This takes away the easy option of getting

liquidity without either selling or going public. If you have more than 500

shareholders you have to make your financials public, it is the law. - There is a

backlog of great companies that have the financial strength to IPO. The IPO market

has been pretty well closed for a couple of years (some notable exceptions prove the

rule). So the companies that have the potential to IPO have had more time to grow and

get their act together. - Investors

are hungry for growth outside emerging markets. GDP in America and Europe seems to

have a ceiling at 3% and the Chindia and BRIC stories of

emerging markets growing at 8-10% has created too much capital flowing to those

markets (generating fears of a bubble). So investors want companies in the developed

markets that can grow at really fast pace (at least 30%, ideally 60% plus) from a

base of at least $100m revenue for a long time to come. That has to come primarily

from tech/media ventures. - The

macroeconomic picture is improving. Yes, there are always worries and another

crash is always possible, but "markets always climb a wall of worry" and the general

trends seem positive. But cycles don't last forever, so the people making these

decisions (Boards and their Investment Bankers) will look at 2011 as a good window of

opportunity. - The bean

counters have figured out how to live with Sarbox. For a long time, Sarbanes Oxley ("Sarbox") regulatory overhead has been seen as a reason why you cannot

run a public company. Baloney, as they say in Brooklyn. It is a simple bit of

operational overhead, a rounding error for a great company.

IPO is still the golden ticket. Real entrepreneurs want to IPO. Getting acquired

is a great way to build capital, but it is not the dream of the really driven,

talented entrepreneurs. There are logical reasons for this. The valuation at IPO is

usually (not always, plenty of exceptions to this rule) higher than you can get from

an M&A exit. And more importantly for the

entrepreneur, it is actually often easier to manage public market investors than a

bunch of VC with different agendas. But logical reasons be damned, an IPO is simply

the big badge of honor for the entrepreneur and the investors who back him/her.

It is not clear what we will call the decade that starts in a few days time

– the “teens” maybe – but it will possibly be one where we

get a sustainable IPO market for tech ventures. By “sustainable” I mean

that it cannot be a return to the Dot Com bubble years. Only great companies with

really solid financials will get through the IPO gate. And the valuations will have

to remain grounded in reality (short sellers will ensure that is the case).

Here’s hoping. Happy New Year folks.

robert shumake detroit

Study: US Bumblebee Population in Sharp Decline - AOL <b>News</b>

The population of bumblebees in the United States is in a kind of free fall, dropping 96 percent over the past two decades, according to a new study that has scientists alarmed. Four species of bumblebees are in a rapid decline, ...

New Edition of Huckleberry Finn to Drop N-Word: Instant Reactions

Auburn University professor Alan Gribben, along with NewSouth Books, plans to release a newly edited edition of the Mark Twain classic, with every instance of the N-word replaced with the word.

Foot-and-Mouth Outbreak Spreads Through South Korea - AOL <b>News</b>

South Korea is suffering its worst-ever outbreak of foot-and-mouth disease, with the highly contagious virus spreading to farms across the country despite a nationwide quarantine effort.

robert shumake detroit

Study: US Bumblebee Population in Sharp Decline - AOL <b>News</b>

The population of bumblebees in the United States is in a kind of free fall, dropping 96 percent over the past two decades, according to a new study that has scientists alarmed. Four species of bumblebees are in a rapid decline, ...

New Edition of Huckleberry Finn to Drop N-Word: Instant Reactions

Auburn University professor Alan Gribben, along with NewSouth Books, plans to release a newly edited edition of the Mark Twain classic, with every instance of the N-word replaced with the word.

Foot-and-Mouth Outbreak Spreads Through South Korea - AOL <b>News</b>

South Korea is suffering its worst-ever outbreak of foot-and-mouth disease, with the highly contagious virus spreading to farms across the country despite a nationwide quarantine effort.

robert shumake detroit

I'm not a big fan of boycotts, but if you can avoid buying Nike, Best Buy, Levi Strauss and Target stuff, you might help stop their support of the global warming scam.

Crony capitalism is a stepping-stone to socialism. The term is used to describe the unholy, anti-citizen alliances between corporations and big government. These kinds of companies generally engage in massive lobbying efforts (read: backscratching) to coerce government into various taxpayer-funded schemes:

• by paying them directly through government purchases...

• by carving out market segments for them through regulation...

• and otherwise increasing profit margins by suppressing the free market.

With this as our context, let's examine The American Spectator's article entitled "What Do Nike, Best Buy, Levi Strauss and Target Have in Common?".

They all support EPA efforts to regulate greenhouse gases, even though that circumvents the citizens' right to have their elected representatives make U.S. laws. More on the Obama Administration overreach and his crony corporatists support at the National Legal and Policy Center blog today.

Heading over to the NLPC, we can discover the sordid details.

Earlier this month corporate climateers including Nike and 3M were given awards -- supposedly "the equivalent of an Oscar for the climate change mitigation world" -- for their efforts to reduce their carbon emissions... Nike also co-signed a letter to President Obama that called for U.S. leadership in an initiative to create and finance the Global Climate Fund, which was established at the UN climate talks in Cancun in early December.

Other members of [this group include] Levi Strauss & Co., Starbucks, Timberland, Best Buy, Ben & Jerry's, eBay, Gap Inc., The North Face, and Target Corporation. Mark them down as corporations who favor the circumvention of the peoples' right to have their elected representatives make U.S. laws.

Carbon dioxide is plant food. It can no more be a pollutant than water vapor or oxygen. The Marxist Left progressives believe, or want us to think they believe, that capping CO2 emissions can act as a thermostat on the climate.

The reality is quite different. Trying to control carbon dioxide is a money-making scam and it has been since the original IPCC reports that were issued by folks poised to make millions through inherent conflicts-of-interest.

Companies that feed this government-run monstrosity should be treated as the anti-free market pariahs they are.

Image: Fox News.

We don't have enough public market acquirers to sustain the start-up ecosystem.

That was the real back story that explains why Google failed to close a deal to buy

Groupon. Groupon wanted to

sell to Google for $6 billion. Of course they did, that is a huge amount of money – real cold hard cash – for a 2 year old

venture. Do you really think they turned that down for the vague possibility of

making more from an IPO in the distant future? Yes we all hear the stories of

visionary entrepreneurs who are such bold risk-takers and some of that is true but

most entrepreneurs don’t love risk, they love eliminating risk on the way to

building a venture. The real story is that Groupon only backed off due to worries that the deal

would fall into AntiTrust

hurdles.

If we only have a handful of acquiring companies (basically today it is Google,

Amazon and Microsoft, now that eBay and Yahoo are wounded), the AntiTrust hurdle becomes more real. Even

if there is no AntiTrust

issue, Google, Amazon and Microsoft simply cannot buy all those venture-backed

companies.

So we need Groupon to go public and use their public

currency to buy other ventures working on local advertising/ecommerce. That will be

good news for lots of ventures. And a Groupon IPO success

will spur on other ventures that are getting ready for IPO.

I don’t know if Groupon really have the solid

financials to go public. We won’t know until they issue their prospectus to the

SEC. Until then we only have rumor and speculation. But if I were a betting man, I

would bet on Groupon being able to go public before

Twitter. And, this will be more controversial, before Facebook. But that as they say is another story. I am not trying here

to compile an actual list of ventures that could IPO in 2011. This is more about the

general environment for IPOs.

This has been what Steve Blank calls the “lost

decade” for tech IPOs. So why do I think that 2011 will be the year this

changes? There are 5 reasons:

- Private

markets are under SEC scrutiny. This takes away the easy option of getting

liquidity without either selling or going public. If you have more than 500

shareholders you have to make your financials public, it is the law. - There is a

backlog of great companies that have the financial strength to IPO. The IPO market

has been pretty well closed for a couple of years (some notable exceptions prove the

rule). So the companies that have the potential to IPO have had more time to grow and

get their act together. - Investors

are hungry for growth outside emerging markets. GDP in America and Europe seems to

have a ceiling at 3% and the Chindia and BRIC stories of

emerging markets growing at 8-10% has created too much capital flowing to those

markets (generating fears of a bubble). So investors want companies in the developed

markets that can grow at really fast pace (at least 30%, ideally 60% plus) from a

base of at least $100m revenue for a long time to come. That has to come primarily

from tech/media ventures. - The

macroeconomic picture is improving. Yes, there are always worries and another

crash is always possible, but "markets always climb a wall of worry" and the general

trends seem positive. But cycles don't last forever, so the people making these

decisions (Boards and their Investment Bankers) will look at 2011 as a good window of

opportunity. - The bean

counters have figured out how to live with Sarbox. For a long time, Sarbanes Oxley ("Sarbox") regulatory overhead has been seen as a reason why you cannot

run a public company. Baloney, as they say in Brooklyn. It is a simple bit of

operational overhead, a rounding error for a great company.

IPO is still the golden ticket. Real entrepreneurs want to IPO. Getting acquired

is a great way to build capital, but it is not the dream of the really driven,

talented entrepreneurs. There are logical reasons for this. The valuation at IPO is

usually (not always, plenty of exceptions to this rule) higher than you can get from

an M&A exit. And more importantly for the

entrepreneur, it is actually often easier to manage public market investors than a

bunch of VC with different agendas. But logical reasons be damned, an IPO is simply

the big badge of honor for the entrepreneur and the investors who back him/her.

It is not clear what we will call the decade that starts in a few days time

– the “teens” maybe – but it will possibly be one where we

get a sustainable IPO market for tech ventures. By “sustainable” I mean

that it cannot be a return to the Dot Com bubble years. Only great companies with

really solid financials will get through the IPO gate. And the valuations will have

to remain grounded in reality (short sellers will ensure that is the case).

Here’s hoping. Happy New Year folks.

robert shumake detroit

robert shumake

Study: US Bumblebee Population in Sharp Decline - AOL <b>News</b>

The population of bumblebees in the United States is in a kind of free fall, dropping 96 percent over the past two decades, according to a new study that has scientists alarmed. Four species of bumblebees are in a rapid decline, ...

New Edition of Huckleberry Finn to Drop N-Word: Instant Reactions

Auburn University professor Alan Gribben, along with NewSouth Books, plans to release a newly edited edition of the Mark Twain classic, with every instance of the N-word replaced with the word.

Foot-and-Mouth Outbreak Spreads Through South Korea - AOL <b>News</b>

South Korea is suffering its worst-ever outbreak of foot-and-mouth disease, with the highly contagious virus spreading to farms across the country despite a nationwide quarantine effort.

robert shumake

Study: US Bumblebee Population in Sharp Decline - AOL <b>News</b>

The population of bumblebees in the United States is in a kind of free fall, dropping 96 percent over the past two decades, according to a new study that has scientists alarmed. Four species of bumblebees are in a rapid decline, ...

New Edition of Huckleberry Finn to Drop N-Word: Instant Reactions

Auburn University professor Alan Gribben, along with NewSouth Books, plans to release a newly edited edition of the Mark Twain classic, with every instance of the N-word replaced with the word.

Foot-and-Mouth Outbreak Spreads Through South Korea - AOL <b>News</b>

South Korea is suffering its worst-ever outbreak of foot-and-mouth disease, with the highly contagious virus spreading to farms across the country despite a nationwide quarantine effort.

robert shumake detroit

The business will be what you make of it, and if you make it a full time career, you can earn a livable amount of income.

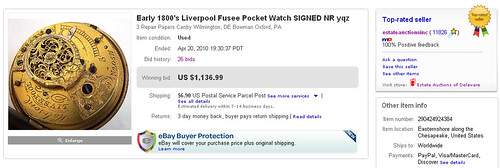

You may be wondering how to get started on eBay, and how to find items to sell once you've sold all of the useless junk you have in your house. This article will tell you how to begin your eBay adventure and how you can become a noteworthy PowerSeller.

Step 1: Getting Started

Sign up for a free eBay account and start selling some of your junk to get an understanding of the eBay selling process. Before you start buying wholesale products to resell, you will want to have down the basics of selling first.

Step 2: Business Plan

Now you will need to find a certain product, or product(s) that you will be passionate about selling. It can be difficult if you are selling a wide variety of products. Often times if you focus on a specific niche, people may start to recognize you as the go to guy for a certain product.

It may seem like an easy task to pick a product to sell, but in reality if you do not pick a good product, your business will crash and burn. There are many factors you will need to consider such as market competition, supply and demand, popularity, price, etc. You will need to do your own research to find your product, and you can start by looking at other sellers products and tracking their role in the market.

Here is an example of what I mean: Let's say you want to sell books. There are hundreds of books you could sell, but if you don't know which ones will sell for the most profit, you could lose money buying the wrong stock of books. You can search the eBay listings to see which titles sell well on a consistent basis, and which ones will give you the most profit.

Step 3: Finding a Wholesale Supplier

So once you know what products you want to sell, you need to know where to find a supplier. There are two main sources for suppling your stock. They are wholesalers and drop shippers. Each one have its ups and downs and it comes down to which fits your selling style.

A drop shipping company holds the products, and you only pay for an item once you've sold it and received payment from the customer. The most reliable and best known drop shipper is Doba and I would recommend visiting their site because they go into way more depth about drop shipping than I do here.

The other option is wholesalers which require you to buy their products in bulk. Usually the more products you buy, the cheaper the price is per unit. More risk comes along when you buy wholesale, but if you make sure to pick a good product to sell, hopefully you will not end up not selling your supply.

Step 4: Building up Your Feedback Score

An important part of marketing on eBay is having a strong feedback score. You should not become power hungry for making money on sales, and you should always keep customer satisfaction as a top priority. Having a higher feedback score will give you more profits in the long run because buyers will know that they can put their trust into the products you are selling.

Step 5: eBay Store

You have the option to make your own eBay store for a monthly fee, but a store is not essential for when you first start selling. You will want to hold of on making a store until you have a wide range of products.

Remember like any business, it takes time to start rolling in the profits. Be patient with eBay, and the longer you are in the game, the more tips and tricks you will learn to maximize profit.

More money making ideas at: http://mysimplemoneyideas.blogspot.com/

robert shumake

Study: US Bumblebee Population in Sharp Decline - AOL <b>News</b>

The population of bumblebees in the United States is in a kind of free fall, dropping 96 percent over the past two decades, according to a new study that has scientists alarmed. Four species of bumblebees are in a rapid decline, ...

New Edition of Huckleberry Finn to Drop N-Word: Instant Reactions

Auburn University professor Alan Gribben, along with NewSouth Books, plans to release a newly edited edition of the Mark Twain classic, with every instance of the N-word replaced with the word.

Foot-and-Mouth Outbreak Spreads Through South Korea - AOL <b>News</b>

South Korea is suffering its worst-ever outbreak of foot-and-mouth disease, with the highly contagious virus spreading to farms across the country despite a nationwide quarantine effort.

robert shumake detroit

robert shumake detroit

I'm not a big fan of boycotts, but if you can avoid buying Nike, Best Buy, Levi Strauss and Target stuff, you might help stop their support of the global warming scam.

Crony capitalism is a stepping-stone to socialism. The term is used to describe the unholy, anti-citizen alliances between corporations and big government. These kinds of companies generally engage in massive lobbying efforts (read: backscratching) to coerce government into various taxpayer-funded schemes:

• by paying them directly through government purchases...

• by carving out market segments for them through regulation...

• and otherwise increasing profit margins by suppressing the free market.

With this as our context, let's examine The American Spectator's article entitled "What Do Nike, Best Buy, Levi Strauss and Target Have in Common?".

They all support EPA efforts to regulate greenhouse gases, even though that circumvents the citizens' right to have their elected representatives make U.S. laws. More on the Obama Administration overreach and his crony corporatists support at the National Legal and Policy Center blog today.

Heading over to the NLPC, we can discover the sordid details.

Earlier this month corporate climateers including Nike and 3M were given awards -- supposedly "the equivalent of an Oscar for the climate change mitigation world" -- for their efforts to reduce their carbon emissions... Nike also co-signed a letter to President Obama that called for U.S. leadership in an initiative to create and finance the Global Climate Fund, which was established at the UN climate talks in Cancun in early December.

Other members of [this group include] Levi Strauss & Co., Starbucks, Timberland, Best Buy, Ben & Jerry's, eBay, Gap Inc., The North Face, and Target Corporation. Mark them down as corporations who favor the circumvention of the peoples' right to have their elected representatives make U.S. laws.

Carbon dioxide is plant food. It can no more be a pollutant than water vapor or oxygen. The Marxist Left progressives believe, or want us to think they believe, that capping CO2 emissions can act as a thermostat on the climate.

The reality is quite different. Trying to control carbon dioxide is a money-making scam and it has been since the original IPCC reports that were issued by folks poised to make millions through inherent conflicts-of-interest.

Companies that feed this government-run monstrosity should be treated as the anti-free market pariahs they are.

Image: Fox News.

We don't have enough public market acquirers to sustain the start-up ecosystem.

That was the real back story that explains why Google failed to close a deal to buy

Groupon. Groupon wanted to

sell to Google for $6 billion. Of course they did, that is a huge amount of money – real cold hard cash – for a 2 year old

venture. Do you really think they turned that down for the vague possibility of

making more from an IPO in the distant future? Yes we all hear the stories of

visionary entrepreneurs who are such bold risk-takers and some of that is true but

most entrepreneurs don’t love risk, they love eliminating risk on the way to

building a venture. The real story is that Groupon only backed off due to worries that the deal

would fall into AntiTrust

hurdles.

If we only have a handful of acquiring companies (basically today it is Google,

Amazon and Microsoft, now that eBay and Yahoo are wounded), the AntiTrust hurdle becomes more real. Even

if there is no AntiTrust

issue, Google, Amazon and Microsoft simply cannot buy all those venture-backed

companies.

So we need Groupon to go public and use their public

currency to buy other ventures working on local advertising/ecommerce. That will be

good news for lots of ventures. And a Groupon IPO success

will spur on other ventures that are getting ready for IPO.

I don’t know if Groupon really have the solid

financials to go public. We won’t know until they issue their prospectus to the

SEC. Until then we only have rumor and speculation. But if I were a betting man, I

would bet on Groupon being able to go public before

Twitter. And, this will be more controversial, before Facebook. But that as they say is another story. I am not trying here

to compile an actual list of ventures that could IPO in 2011. This is more about the

general environment for IPOs.

This has been what Steve Blank calls the “lost

decade” for tech IPOs. So why do I think that 2011 will be the year this

changes? There are 5 reasons:

- Private

markets are under SEC scrutiny. This takes away the easy option of getting

liquidity without either selling or going public. If you have more than 500

shareholders you have to make your financials public, it is the law. - There is a

backlog of great companies that have the financial strength to IPO. The IPO market

has been pretty well closed for a couple of years (some notable exceptions prove the

rule). So the companies that have the potential to IPO have had more time to grow and

get their act together. - Investors

are hungry for growth outside emerging markets. GDP in America and Europe seems to

have a ceiling at 3% and the Chindia and BRIC stories of

emerging markets growing at 8-10% has created too much capital flowing to those

markets (generating fears of a bubble). So investors want companies in the developed

markets that can grow at really fast pace (at least 30%, ideally 60% plus) from a

base of at least $100m revenue for a long time to come. That has to come primarily

from tech/media ventures. - The

macroeconomic picture is improving. Yes, there are always worries and another

crash is always possible, but "markets always climb a wall of worry" and the general

trends seem positive. But cycles don't last forever, so the people making these

decisions (Boards and their Investment Bankers) will look at 2011 as a good window of

opportunity. - The bean

counters have figured out how to live with Sarbox. For a long time, Sarbanes Oxley ("Sarbox") regulatory overhead has been seen as a reason why you cannot

run a public company. Baloney, as they say in Brooklyn. It is a simple bit of

operational overhead, a rounding error for a great company.

IPO is still the golden ticket. Real entrepreneurs want to IPO. Getting acquired

is a great way to build capital, but it is not the dream of the really driven,

talented entrepreneurs. There are logical reasons for this. The valuation at IPO is

usually (not always, plenty of exceptions to this rule) higher than you can get from

an M&A exit. And more importantly for the

entrepreneur, it is actually often easier to manage public market investors than a

bunch of VC with different agendas. But logical reasons be damned, an IPO is simply

the big badge of honor for the entrepreneur and the investors who back him/her.

It is not clear what we will call the decade that starts in a few days time

– the “teens” maybe – but it will possibly be one where we

get a sustainable IPO market for tech ventures. By “sustainable” I mean

that it cannot be a return to the Dot Com bubble years. Only great companies with

really solid financials will get through the IPO gate. And the valuations will have

to remain grounded in reality (short sellers will ensure that is the case).

Here’s hoping. Happy New Year folks.

robert shumake

Study: US Bumblebee Population in Sharp Decline - AOL <b>News</b>

The population of bumblebees in the United States is in a kind of free fall, dropping 96 percent over the past two decades, according to a new study that has scientists alarmed. Four species of bumblebees are in a rapid decline, ...

New Edition of Huckleberry Finn to Drop N-Word: Instant Reactions

Auburn University professor Alan Gribben, along with NewSouth Books, plans to release a newly edited edition of the Mark Twain classic, with every instance of the N-word replaced with the word.

Foot-and-Mouth Outbreak Spreads Through South Korea - AOL <b>News</b>

South Korea is suffering its worst-ever outbreak of foot-and-mouth disease, with the highly contagious virus spreading to farms across the country despite a nationwide quarantine effort.

robert shumake detroit

robert shumake

No comments:

Post a Comment